Hope the above helps. Also as per Budget 2018 the rate of interest applicable on EPF is 865.

Review Of Confirmation Of Payment Of Epf Contribution By Contractors In R O Of Outsourcing Staff Staffnews

Yes as per section 224x Employee contribution to PF is firstly treated as income of the Employer and then he gets deduction after the payment made.

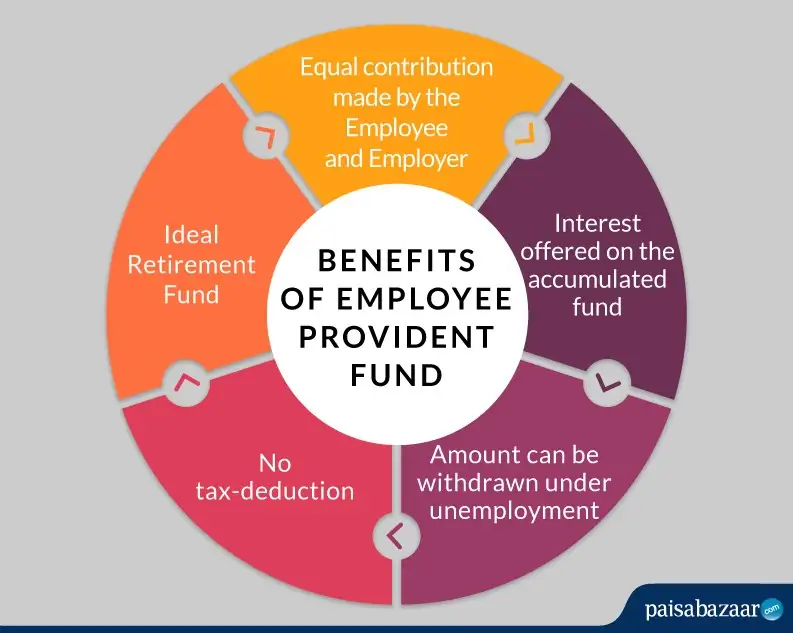

. In such case employer has to pay administrative charges on the higher wages wages above 15000-. No limit to the amount of contribution that is made towards the account. Contribution paid by the employer is 12 per cent of basic wages plus dearness allowance plus retaining allowance.

Due to the recent Covid situation the ITR for 2018-19 can now be revised up to 30 June 2020. As mentioned earlier. 13 of salary Interest on PF.

Establishment of the Board. EPF Dividend Rate. The contribution by employer employee are payable on maximum wage ceiling of Rs.

All employees earning basic salary DA Retain allowance upto Rs. Division of EPF contribution. Your employers contribution to your EPF is also tax-free.

So your total salary from above example will be Rs46000. EPF contribution is divided into two parts. Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550.

February 1 2018 at 1. The interest earned on the EPF Account balance every year is tax-free. PART II THE BOARD AND THE INVESTMENT PANEL.

An equal contribution is payable by the employee also. As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. Subscribers are eligible for a tax deduction of up to Rs2 lakh.

However the maximum deduction that can be claimed is Rs 15 lakh including all other investments and expenses allowed under the section. Employers EPF contribution rate Employees EPF contribution rate Monthly salary rate RM5000 and below More than RM5000 RM5000 and below More than RM5000 Malaysian age 60 and above 4 0 Malaysian below age 60 13 12 9 Permanent resident below age 60 13 12 9 Permanent resident age 60 and above 65 6 55. As per the Employee Provident Fund rules the employer contributions are payable on maximum wage ceiling of 15000.

And the best part is that the money that you. I worked for an employer from 2012 to Aug 2018 lets say A and then joined company BPF under Trust account from Sep 2018 will be resigning this month and will join Company C in Mar 2019. Rebate us 80C is available Employers contribution.

As mentioned earlier interest on EPF is calculated monthly. What is the dividend rate for EPF Self Contribution. So lets use this for the example.

16 of Interest rate. Section 361va Allowed as general business expenditure Us 36. Due date for purpose.

Theyll detect when receiving the EPF statutory contribution from the employer under statutory. Earlier in the year 2016-17 and 2018-19 the EPFO had given an 865 rate of interest to the subscribers. Employee Employer contribution is 12 each of Basic salary DA Retain allowance.

The interest rate on EPF is reviewed on a yearly basis. But this rate is revised every year. The rate of contribution to PF is 12.

The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. The tax ability of PF can only be considered in case of withdrawal from the fund other wise in cases whatever the amount contributed by the employer more is not at all taxable to the employee. The EPF interest rate for FY 2018-2019 was 865.

Above 15000 by submitting a joint request from Employee and employer as required in Para 266 of EPF Scheme. For EPF i-Saraan contribution from the year 2018 until the year 2022. To better understand how EPF can help you take a look at how you and your employer contribute to it.

Currently I can see Two PF accounts under my UAN account and I never raised a request to transfer amount from A to B and I dont know if its done. Total EPF contribution every month 1800 550 2350. EPF act applies to factories and establishments having 20 or more employees.

Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. However the contribution can also be done on higher wages ie. It was 880 in 2015-16.

For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and. The EPF interest rate for the fiscal year 2022-23 is 810. Per Annum Simpanan Shariah.

Rs250 must be made towards the account. But from now onwards it includes BasicDAAllowances. Contributions for a particular month will be eligible for dividend based on the.

To pay contribution on higher wages a joint request from Employee and employer is required Para 266 of EPF Scheme. As of now the EPF interest rate is 850 FY 2019-20. Contribution to EPF will be 12 of Rs46000 which is.

September 2 2020 at 711 pm. A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952. Presently the following three schemes are in operation.

Further the income tax return for 2018-19 ordinarily could be revised up to 31 March 2020. You are so helpful. EPF Interest Rates 2022 2023.

When the employer contributes 12 to provident fund 367 is contributed to the provident fund and rest is diverted towards pension scheme. 15000 pm are eligible for PF. Firstly considered as income.

Lets use this latest EPF rate for our example. Rs500 or Rs1000 in a year must be made towards the account. No limit to the amount of contribution.

The EPF interest rate for FY 2018-2019 is 865. For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. When the EPFO announces the interest rate for a fiscal year and the year closes the interest rate is computed for the month-by-month closing balance and then for the entire year.

In case of establishments which employ less than 20 employees or meet certain other conditions as notified by the EPFO the contribution rate for both employee and the employer. Male employees must contribute 10 or 12 of their basic salary. Thank you so much.

The fund is financed by the transferring a part of employers contribution towards an employees provident fund to pension fund ie. Previously as the meaning of salary was only BasicDA so 12 of Rs30000Rs3600 was considered for EPF payout from your end and equally from your employer end too.

Epf Contribution Reduced From 12 To 10 For Three Months

Epf Contribution Rates 1952 2009 Download Table

Epf Tax Rates Applicability Benefits And Payment Procedure Superca

Epf Payment Online Procedure Receipt Download Late Payment Penalty

Pf Interest Calculator Flash Sales 52 Off Www Ingeniovirtual Com

Pf Interest Calculator Flash Sales 52 Off Www Ingeniovirtual Com

How Epf Employees Provident Fund Interest Is Calculated

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Pf Interest Calculator Flash Sales 52 Off Www Ingeniovirtual Com

Epf Rules For Employer 2018 19 Registration And Contribution Planmoneytax

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

New Epf Rules 2021 Latest Amendments To Epf Act

Epf Concerned That Over 70 Of Members Opted For 7 Contribution Rate

Epf Interest Rate 2022 23 Unacademy

Pdf Epf Contribution Rate 2020 21 Pdf City In

What Is The Epf Contribution Rate Table Wisdom Jobs India